ATTN BP Employees,

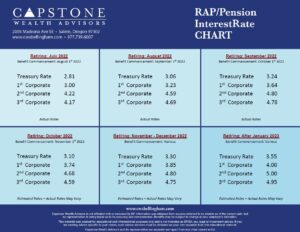

Interest rates for June, impacting retirees collecting their BP RAP benefits on October 1st, 2022, were mostly in-line with our estimates, which called for a dramatic increase in interest rates from May’s figures. While this increase is the largest increase we have seen in several months, it comes as no surprise due to the Federal Reserve increasing interest rates to combat stubbornly high levels of inflation.

Interest rates for June, impacting retirees collecting their BP RAP benefits on October 1st, 2022, were mostly in-line with our estimates, which called for a dramatic increase in interest rates from May’s figures. While this increase is the largest increase we have seen in several months, it comes as no surprise due to the Federal Reserve increasing interest rates to combat stubbornly high levels of inflation.

Next month however, we anticipate the Treasury Rate, 2nd & 3rd corporate segment rates to decrease slightly from current levels, and the 1st corporate segment to increase slightly. It is our view that this net overall decrease is likely to be temporary, lasting only a short period of time as the Fed is almost certain to continue hiking rates until we see a meaningful reduction in inflation, which currently sits at 9.1%.

On July 28th, 2022, US Gross Domestic Product (GDP) figures were released showing a -0.9% contraction in our economy. This means the US has now seen two consecutive quarters of negative GDP growth – meeting both the classic and technical definition of a recession.

The drop in rates expected for next month is based on comments by Federal Reserve Chairman Jerome Powell, saying in a recent press conference that he is seeing signs the Fed’s efforts are starting to take effect faster than originally expected and that market assumptions of future rate hikes are too high. This caused the bond market to adjust to this new information and thus the overall reduction in rates for next month’s pension figures.

The drop in rates may come as a welcome sign for those of you looking to retire later this year, however rates for August and September are still more ideal comparatively speaking. If you are looking to retire in this highly volatile interest rate environment, we strongly advise you consult with one of our Financial Advisors specializing in BP retirement plans prior to making any decisions. The month you select to collect your pension is an irrevocable decision once it has started and choosing the wrong month can have significant impact on the amount of money you receive from your pension plan.

If you would like to learn more about how your pension is impacted by interest rates or if you are concerned at the overall situation of financial markets today, please do not hesitate to contact one of our experienced financial advisors who specializes in knowing the inner working of your BP RAP plan. This service is free of charge for all BP Employees and Retirees.

To schedule a complimentary consultation with our team email info@capstonewealthadvisors.com or call us directly at (877)739-6007.

Regards,

Capstone RIA

Bellingham, WA

877-739-6007

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk, including loss of principal. International & Emerging Markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in Emerging Markets.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Confidentiality Notice: This email transmission and its attachments, if any, are confidential and intended only for the use of particular persons and entities. They may also be work product and/or protected by the attorney-client privilege or other privileges. Delivery to someone other than the intended recipient(s) shall not be deemed to waive any privilege.

Capstone RIA and its representatives are separate and apart from any other named entity.