ATTN BP Employees,

What You Need to Know:

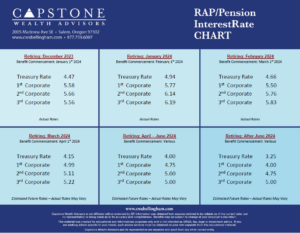

- Interest Rates used to calculate your BP RAP pension significantly decreased this month, which is a welcomed relief for those of you considering taking the pension lump-sum next year. We expect rates impacting your BP RAP to continue their decline over the coming months.

- What Does this Mean for You? With rates estimated to decline, this could mean a positive impact to your lump-sum value is on its way. We strongly encourage you to contact us to discuss the impact these rates could have on your BP RAP and your overall retirement goals. We can help you understand the best option for your long-term retirement planning needs.

- Why are the Rates Changing? Fed Chair Powell finally made his much-anticipated “pivot” at the close of the Fed’s two-day December meeting, saying he sees short-term rates heading lower next year. Perhaps much lower. Surprised but excited, the financial markets rallied on the Fed’s policy pivot. But market watchers know the hard part comes next—how to position portfolios in a falling rate environment, which historically has not been favorable to stocks.

- What’s Next? Judging from the Fed’s outlook, it appears that we are entering a transition period that will eventually lead to lower rates. But keep in mind, nothing is certain until the Fed acts.

Need Some Guidance?

If all of this feels a bit confusing, don’t worry. We’re here to help! Our team of financial advisors is well-versed in all things related to BP retirement plans. Whether it is the BP RAP, ESP, SVP, RRSP, or any other BP-related plans, we’ve got you covered.

Want to learn more? Simply email us at info@capstonewealthadvisors.com or give us a call at (877)739-6007.

Best wishes,

Capstone Wealth Advisors

Bellingham, WA

877-739-6007

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk, including loss of principal. International & Emerging Markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in Emerging Markets.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Confidentiality Notice: This email transmission and its attachments, if any, are confidential and intended only for the use of particular persons and entities. They may also be work product and/or protected by the attorney-client privilege or other privileges. Delivery to someone other than the intended recipient(s) shall not be deemed to waive any privilege.

Capstone Wealth Advisors and its representatives are separate and apart from any other named entity.