ATTN HF Sinclair Employees,

For those of you who are taking advantage of our new direct 401(k) management service, your account will be updated to reflect our current allocation recommendations; you do not need to take any action. If you do not currently utilize our 401(k) management services and would like more information, please email us by clicking here and we will schedule a time to discuss the options and benefits of having your 401(k) actively managed.

During volatile markets, risk management quickly becomes a top priority for investors. It is important to have a sound risk management strategy in place. At Capstone Wealth Advisors, we can help you evaluate your risk tolerance and create a diversified investment portfolio that balances risk and reward. We can also help you adjust your portfolio as market conditions change, to keep your risk tolerance appropriate for your investment time horizon and long-term goals.

As noted above, we cannot overstate the importance of having an experienced, professional Financial Advisor to help you determine what is the best approach for you given your individual risk tolerance, time horizon and long-term goals. We offer free risk assessments to all HF Sinclair employees and retirees.

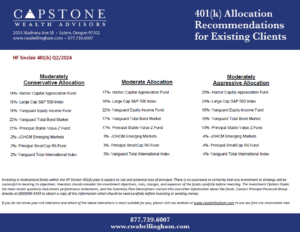

To better understand which of our model 401(k) allocations is right for you, please follow the link below to a brief survey that will help you determine what your risk tolerance is.

Click Here for Your Free Risk Tolerance Assessment

If you would like to schedule a consultation with one of our professional financial advisors, please email info@capstonewealthadvisors.com or contact our office directly at (877)739-6007.

Regards,

Capstone Wealth Advisors

877-739-6007

Bellingham, WA @cwabellingham Financial Planning Team.

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk, including loss of principal. International & Emerging Markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in Emerging Markets.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Confidentiality Notice: This email transmission and its attachments, if any, are confidential and intended only for the use of particular persons and entities. They may also be work product and/or protected by the attorney-client privilege or other privileges. Delivery to someone other than the intended recipient(s) shall not be deemed to waive any privilege.

Capstone Wealth Advisors and its representatives are separate and apart from any other named entity.