BP EMPLOYEES,

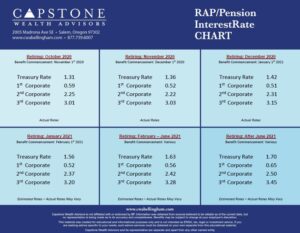

Interest rates for September (affecting January benefit commencement dates) rose moderately and were mostly in line with our projections. Last month’s rate increases mark the first increase in several months and we anticipate this to continue, especially if there is no additional stimulus passed by congress. Based on this increase, December is currently the best month to claim your pension lump sum.

Interest rates for September (affecting January benefit commencement dates) rose moderately and were mostly in line with our projections. Last month’s rate increases mark the first increase in several months and we anticipate this to continue, especially if there is no additional stimulus passed by congress. Based on this increase, December is currently the best month to claim your pension lump sum.

With the current round of severance packages being offered by BP, many of you are looking at separating from BP at the end of 2020 or early 2021. The obvious question you might be asking yourself is whether rates will continue to increase over the next few months and will that negatively affect your pension lump sum value. We believe it is unlikely that rates will increase substantially between now and the first quarter of 2021. The more likely situation is that rates will remain relatively flat over the next few months, however this depends largely on the outcome of current federal stimulus talks. If Congress approves another round of stimulus, there could be further downward pressure on rates, helping them remain low. If there is no additional stimulus, then we would anticipate seeing the 2nd and 3rd corporate segment rates showing the bulk of the increase in rates.

If you would like to understand what your options are or how you could benefit from professional advice, we are here to help. Knowing and understanding the intricacies of not only your pension account, but also all other retirement plan options offered through BP is our undivided specialty. We would highly encourage you to talk with one of our retirement planning specialists who can help you understand what your potential retirement timeline looks like and how to strategically plan your exit. Please email info@capstonewealthadvisors.com or call (877)739-6007 to schedule a complimentary consultation. There is no charge for this service.

Tyler E Ryan

877-739-6007

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk, including loss of principal. International & Emerging Markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in Emerging Markets.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Confidentiality Notice: This email transmission and its attachments, if any, are confidential and intended only for the use of particular persons and entities. They may also be work product and/or protected by the attorney-client privilege or other privileges. Delivery to someone other than the intended recipient(s) shall not be deemed to waive any privilege.

Capstone RIA and its representatives are separate and apart from any other named entity.