BP EMPLOYEES,

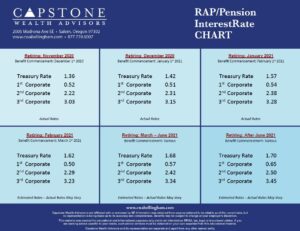

Interest rates for October (affecting February benefit commencement dates) rose across the board and finished in line with our forecasts from last month. It also marked the second consecutive month that interest rates have risen from their historically low levels. Currently we anticipate November’s interest rates to finalize very close to where they are for October – meaning BP Employees should expect to see little change in their pension lump sum value between February and March. Most employees separating from BP in the near future are doing so because of the voluntary and involuntary separations being announced. For those impacted, most will be separated either by the end of this year or by March 31st of 2021. As we move into the final month of 2020, January 2021 becomes the most opportune month to collect your pension lump sum benefit.

Understanding how to navigate your BP retirement benefits can be very complicated. We highly recommend you seek advice from one of our financial professionals so you can have the comfort and assurance knowing you are making the most beneficial decision with your BP pension. All too often we hear stories from clients who have coworkers who made the wrong decision solely because they did not understand how the plan rules impacted the collection process. If you are unsure whether you are electing appropriately, please contact our office.

Looking into the first part of next year, we anticipate seeing a continued interest rate increase over time and while an increase generally hurts your pension value, it also means that our economy is doing well and that will likely drive other areas of investment portfolios higher.

If you would like to understand what your options are or how you could benefit from professional advice, we are here to help. Please email info@capstonewealthadvisors.com or call (877)739-6007 to schedule a complimentary consultation. There is no charge for this service.

Tyler E Ryan

877-739-6007

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk, including loss of principal. International & Emerging Markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in Emerging Markets.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Confidentiality Notice: This email transmission and its attachments, if any, are confidential and intended only for the use of particular persons and entities. They may also be work product and/or protected by the attorney-client privilege or other privileges. Delivery to someone other than the intended recipient(s) shall not be deemed to waive any privilege.

Capstone Wealth Advisors and its representatives are separate and apart from any other named entity.