Want to Make the Most of Your Marathon Benefits?

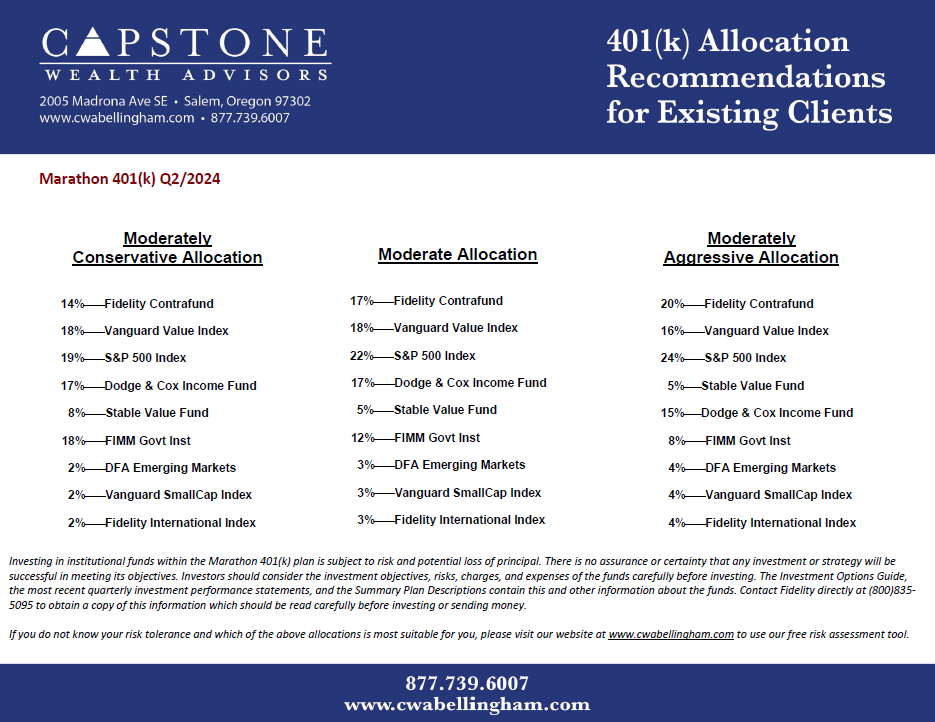

Capstone Wealth Advisors can help you make the most of your Marathon Petroleum retirement plan benefits and take the guess work out of which investment options to select. We provide quarterly custom-built asset allocation recommendations specifically designed for the options available in your Thrift Plan. If you would like to receive regular updates as they are released you can sign up for our newsletter here.

Marathon Thrift Plan 401(k) Overview

While most employees assume it is just a basic Thrift Plan 401(k), it is actually much more. Marathon Oil has one of the leading and most competitive retirement savings plans in the industry and if funded properly can allow you 300% higher funding options. Capstone Wealth Advisors offers generic asset allocation models to assist you with how you may want to structure your investments inside your Marathon Petroleum Thrift Plan.

Did you know you can actively manage the funds in your Thrift Plan 401(k)?

Your Marathon Oil 401(k) is designed as a suite of retirement options aimed at giving you the highest IRS allowed contribution levels. As an employee, you can contribute $22,500 in 2023 ($30,000 if you are over 50) of pre-tax or Roth savings to the Marathon Oil Thrift Plan. Additionally, your Thrift plan allows you to make “After-Tax” contributions in excess of the regular funding limits which allows you to save even more than most plans for retirement. If you are someone who overfunds your 401(k) plan there are several special options available for you. These options range widely but generally will allow you significant long-term tax benefits above and beyond what is normally provided. Because every individual employee’s situation is unique it is important you consult with a financial professional who specializes in knowing the details of your plan. For assistance please click here to contact our team.

What does “vesting” mean to you?

The term “vesting” refers to the portion of company matching dollars that are legally yours to keep. Eligible Marathon Petroleum employees are immediately 100% vested (i.e. have ownership) in Company-matching contributions and are always 100% vested in their own contributions.

Need to take a loan or partial withdrawal from your Thrift Plan?

While you are employed with Marathon Petroleum, you have access to your Thrift Plan accounts through a loan provision and a partial withdrawal. The amount you are permitted to borrow is 50% of your vested account balance, or a maximum of $50,000. If you have had a loan in the past 12 months, the amount you can borrow will be further reduced by your highest outstanding loan balance on any given day in the past 12 months. This is an IRS rule.

Marathon Pension Plan Overview

“Marathon Petroleum offers a Retirement Plan to help provide you with income once you retire. To be eligible to participate in the Retirement Plan, you must be a Regular Full-time, Regular Part-time or Casual employee. Coverage is provided automatically when you begin employment; enrollment is not necessary. The Marathon Petroleum Retirement Plan is an accrued based (Cash Balance) benefit and is provided entirely at Company expense. Marathon Petroleum will provide annual Pay Credits at 7%, 9% or 11% of eligible pay. Pay Credit percentages are determined on December 31 each year, using the sum of your age and Cash Balance service. Marathon Petroleum will also provide Interest Credits, which are compounded monthly.” -Marathon Benefits Guide 2020

Other Retirement Plan Benefit Options available

Health Savings Account (HSA)

A Health Saving Account (HSA) is used to help pay for current medical expenses with tax-free dollars, or to help you save for future medical expenses. The money in your HSA is yours to keep while employed or as you separate or retire from Marathon. Key features of an HSA account include:

- Triple tax advantaged account.

- For 2020, Marathon Petroleum will contribute to your HSA: $500 for Employee Only; $1,000 for all Employee + Dependent(s) options.

- For 2020, the maximum contributions allowed to an HSA are as follows:

- Employee only: $3,550 ($500 Marathon Contribution (MC) + $3,050 employee)

- Employee + Dependent(s): $7,100 ($1,000 MC + $6,100 employee)

- Participants age 55 and older may make an additional $1,000 catch-up contribution.

- Your balance in the HSA rolls over from year to year, so you can use it to save for future health care expenses even after you retire.

Flexible Spending Account (FSA)

A Flexible Savings Account (FSA) allows you to save pre-tax money to help pay for eligible medical, dental or vision expenses for you and your tax dependents throughout the year.

- The maximum annual contribution is $2,700 (minimum is $120 annually).

- You FSA contributions are divided evenly throughout the year and deducted from each paycheck before taxes are withheld, but your full election is available for immediate use.

- You can carry over up to $500 into 2021.

Looking for assistance in managing your assets?

To join the growing number of Marathon employees we assist with asset management, call us today to schedule a complimentary consultation. Our team can help assist you in all areas of retirement and have been working with oil & gas employees for over 17 years. We keep our clients’ best interest at the forefront of our decision-making and focus on you. Contact us today!