BP Employees:

You may be asking yourself why this dramatic change? Here is our take…

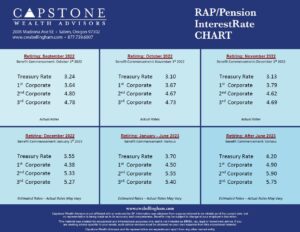

Financial Markets had expected the August Consumer Price Report to show a substantial cooling of inflation, potentially allowing the Fed to ease up on interest rate hikes. Instead, the elevated inflation number not only undercut those easing hopes but raised the possibility of more significant rate hikes in the coming months. On September 21st, this came to fruition when the Federal Reserve raised benchmark interest rates by another three-quarters of a percentage point and indicated it will keep hiking well above the current level to combat inflation. With most investors already believing we are headed toward a deepening recession; we anticipate that the US economy will slowly weaken over the course of the next several quarters as the Fed is forced to keep increasing interest rates and reducing the supply of money in the economy. This will likely translate to bond rates continuing to increase as we approach the end of 2022.

If our estimates are correct for next month, after December 1st, 2022, would not be an advantageous month to collect your BP RAP benefits. If you are considering retiring this year or next, we cannot stress enough the importance of getting professional advice during this highly volatile time. Financial markets are likely to continue their downward trend as we look at the remainder of 2022. Choosing the wrong month to collect your retiree benefits could cost you thousands of dollars. Our team at Capstone Wealth Advisors specializes in knowing the inner workings of your BP Retirement Plans and how to help you make the decision that best suits your individual situation.

If you would like to learn more about how your pension is impacted by interest rates or if you are concerned at the overall situation of financial markets today and would like advice about how we believe you should navigate it, please do not hesitate to contact one of our experienced financial advisors who specializes in knowing the inner working of your BP RAP plan. This service is free of charge for all BP Employees and Retirees.

To schedule a complimentary consultation with our team email info@capstonewealthadvisors.com or call us directly at (877)739-6007.

Regards,

Capstone Wealth Advisors

Bellingham, WA

877-739-6007

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk, including loss of principal. International & Emerging Markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in Emerging Markets.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Confidentiality Notice: This email transmission and its attachments, if any, are confidential and intended only for the use of particular persons and entities. They may also be work product and/or protected by the attorney-client privilege or other privileges. Delivery to someone other than the intended recipient(s) shall not be deemed to waive any privilege.

Capstone Wealth Advisors and its representatives are separate and apart from any other named entity.