BP Employees:

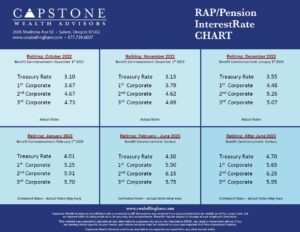

Inflation’s “stubbornness” has been on full display in recent weeks: First, the Producer Price Index (PPI) showed that costs remain high for producers of goods and services. Then in September’s more widely followed Consumer Price Index (CPI) high prices continued to persevere. To address inflation, the Fed’s primary tool is raising short-term interest rates. As it pushes rates higher, the Fed aims to slow the economy by raising borrowing costs. As economic activity cools, the Fed expects to see the CPI and PPI trend lower. At it’s November meeting, the Fed is expected to raise short-term rates another 0.75% to between 3.75% – 4%. Professional traders now expect an additional 0.50-0.75% increase at the Fed’s December meeting.

If you are considering retiring this year or next, we cannot stress enough the importance of getting professional advice during this highly volatile time. Financial markets are likely to continue their downward trend as we look at the remainder of 2022. Choosing the wrong month to collect your retiree benefits could cost you thousands of dollars. Our team at Capstone Wealth Advisors specializes in knowing the inner workings of your BP Retirement Plans and how to help you make the decision that best suits your individual situation.

If you would like to learn more about how your pension is impacted by interest rates or if you are concerned at the overall situation of financial markets today and would like advice about how we believe you should navigate it, please do not hesitate to contact one of our experienced financial advisors who specializes in knowing the inner working of your BP RAP plan. This service is free of charge for all BP Employees and Retirees.

To schedule a complimentary consultation with our team email info@capstonewealthadvisors.com or call us directly at (877)739-6007.

Regards,

Capstone Wealth Advisors

Bellingham, WA

877-739-6007

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk, including loss of principal. International & Emerging Markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in Emerging Markets.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Confidentiality Notice: This email transmission and its attachments, if any, are confidential and intended only for the use of particular persons and entities. They may also be work product and/or protected by the attorney-client privilege or other privileges. Delivery to someone other than the intended recipient(s) shall not be deemed to waive any privilege.

Capstone Wealth Advisors and its representatives are separate and apart from any other named entity.