ATTN BP Employees,

Since last month, we have seen interest rates remain essentially in-line with what our forecast suggested, however, there may be increased volatility in the coming months. On August 2nd Fitch Ratings, one of the world’s largest and most well-known credit rating agencies downgraded US long-term debt in a bombshell report pointing out that governance standards, especially around debt and fiscal matters, have been declining over the past 20 years. They also noted that the US government doesn’t have a medium-term fiscal plan, which most other countries do. These issues, along with economic shocks, tax cuts, and new spending initiatives, have led to increased debt over the past decade.

Following the release of this report, the stock market immediately sold off and Government bond interest rates spiked.

The report went on further to state that Fitch also predicted the US economy will go into a mild recession in 4Q23 and 1Q24 due to tighter credit conditions, less business investment, and slower consumption. They expect the US’s annual real GDP growth to slow down to 1.2% this year from 2.1% in 2022 and overall growth of just 0.5% in 2024.

To see the full report, click here.

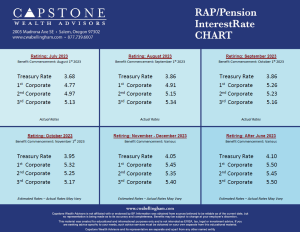

What does this downgrade mean for your pension? A debt rating downgrade could mean higher interest rates in the months following, but for how long? Higher interest rates create less favorable conditions for your pension lump sum. Because of this, we are advising clients to be extremely cautious when deciding when to collect your pension.

If a recession should occur, as Fitch is forecasting, the Federal Reserve may lower interest rates in an effort to reduce borrowing costs and stimulate the economy – making the conditions for your pension lump sum more favorable. However, this is dependent on the recession actually happening.

In short, we’re expecting a lot of ups and downs in both the stock and bond markets in the coming months. As there are pros and cons to both scenarios, we strongly recommend you seek advice from our experienced financial advisors who specialize in knowing the inner workings of your BP retirement plans, including the BP RAP, ESP, SVP, RRSP as well as the other various deferred compensation and stock grant plans offered through BP.

To schedule an appointment please email us at info@capstonewealthadvisors.com or call us directly at (877)739-6007.

Regards,

Capstone Wealth Advisors

Bellingham, WA

877-739-6007

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk, including loss of principal. International & Emerging Markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in Emerging Markets.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Confidentiality Notice: This email transmission and its attachments, if any, are confidential and intended only for the use of particular persons and entities. They may also be work product and/or protected by the attorney-client privilege or other privileges. Delivery to someone other than the intended recipient(s) shall not be deemed to waive any privilege.

Capstone Wealth Advisors and its representatives are separate and apart from any other named entity.