ATTN BP Employees,

As we move past the U.S. election, one thing is clear: the road ahead for interest rates is less predictable. With Wall Street cheering Trump’s second term, small-sized companies—the backbone of America’s private jobs—are well positioned for growth. On the surface, that’s great news for the economy, but navigating the ripple effects if the economy heats up, could cause the Federal Reserve to face pressure to pivot toward higher interest rates sooner than expected, possibly by mid-to-late next year.

As we move past the U.S. election, one thing is clear: the road ahead for interest rates is less predictable. With Wall Street cheering Trump’s second term, small-sized companies—the backbone of America’s private jobs—are well positioned for growth. On the surface, that’s great news for the economy, but navigating the ripple effects if the economy heats up, could cause the Federal Reserve to face pressure to pivot toward higher interest rates sooner than expected, possibly by mid-to-late next year.

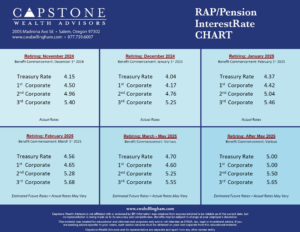

What does this mean for you? It’s all about timing when it comes to your BP Pension (BP RAP). The latest interest rates impacting your pension are in, and we’ve included our detailed forecast in the attached chart for your review. But numbers don’t tell the whole story—that’s where we come in. A common misconception about interest rates is that when the Fed lowers its interest rate (known as the Federal Funds Rate) all rates fall accordingly, but that just isn’t the case. Short-term and Long-term interest rates react differently to economic conditions. Below, we’ve broken things down to give you a clearer picture of what’s happening and how it might impact your retirement planning.

What You Need to Know:

- Interest Rate Trends

- Official interest rates used to calculate your BP RAP pension for February 1st retirement dates closely matched our forecasts.

- For November’s forecast, we anticipate rates to rise significantly, which could affect your future lump-sum calculations.

- Right now, potential retirees should seriously review what this change in rates translates into for your pension value. Heritage and non-Heritage Employees will be affected differently.

- What Does This Mean for You?

- If retirement is on your horizon, fluctuating interest rates could have a big impact on your pension’s lump-sum value.

- In the immediate term, the Fed is still expected to lower rates, but by substantially less than what was previously anticipated pre-election.

- The Fed cut rates in October by 0.25%, bringing the range to 4.50%–4.75%, and another 0.25% cut is expected in December. This trend could work in your favor by increasing the value of your lump sum, but it may not last very long.

- Remember, postponing your pension collection doesn’t affect your retirement eligibility—you can always choose to delay collecting. This flexibility can be advantageous, especially if rates continue to decline.

- Not sure what to do? That’s where we come in. Our financial advisors can help you evaluate your options and make the most informed decision for your BP RAP and overall retirement strategy.

- Why Have Rate Expectations Shifted?

- Economic indicators show a stable labor market, steady GDP growth, and robust consumer spending.

- Inflation is easing, but the Federal Reserve remains cautious, with Chair Jerome Powell describing this phase as a careful “calibration” between controlling inflation and maintaining stability.

- The current Federal Funds rate is 4.50%–4.75%, and while additional cuts are anticipated, there’s no certainty about their timing.

- What’s Next?

- The Federal Reserve’s future moves are now harder to predict, but only two additional rate cuts are widely expected by the end of next year.

- Current forecasts suggest the Federal Funds rate may only drop to 3.75%–4.00% by late Q3 2025, depending on economic data. Only a month previous, the same forecast was expecting a 3.25%–3.50% by June. This indicates a strong shift higher vs previous expectations.

- Staying informed is critical – Shifts in rates could significantly affect your pension’s value and overall retirement plans.

Need Some Guidance?

We get it—this stuff can feel like a maze. But the good news is, you don’t have to navigate it alone. Our team specializes in BP retirement plans, including RAP, ESP, SVP, and RRSP. Whether you’re just exploring your options or ready to take action, we’re here to make the process as smooth and straightforward as possible.

Want to learn more? Email us at info@capstonewealthadvisors.com or call (877) 739-6007. We’re happy to help!

Best wishes,

Capstone Wealth Advisors

Bellingham, WA

877-739-6007

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk, including loss of principal. International & Emerging Markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in Emerging Markets.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Confidentiality Notice: This email transmission and its attachments, if any, are confidential and intended only for the use of particular persons and entities. They may also be work product and/or protected by the attorney-client privilege or other privileges. Delivery to someone other than the intended recipient(s) shall not be deemed to waive any privilege.

Capstone Wealth Advisors and its representatives are separate and apart from any other named entity.