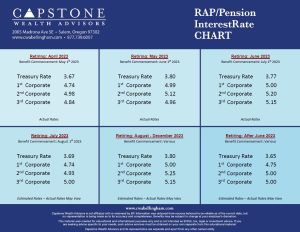

Interest rates were impacted in both directions over the past month with 1st and 2nd segment rates coming in lower than anticipated. The 3rd segment rate and Treasury rate were in line with our estimates. We anticipate corporate segment rates to drop over the coming months, which could provide relief for those looking to collect their pension in the second half of 2023. However, it’s important to note that these expectations can be subject to change based on new economic developments and shifts in the Fed’s policy stance.

During its May interest rate meeting, the Federal Reserve elected to increase its benchmark interest rate to 5%, the highest level since 2007. The market currently expects the Fed to pause hikes for the current economic cycle and begin cutting rates starting in July, however this is in direct contradiction to the publicly made statements by Fed Chair Jerome Powell who has said that he Fed does not expect to decrease rates this year. This all comes amidst the backdrop of a few, recent major bank failures which include the 2nd, 3rd & 4th largest bank failures ever to occur in US history. There are numerous indicators that have been very accurate historically, signaling a recession in the US could be quickly approaching. Investors also face inflation well above normal levels, an ongoing war in Ukraine, heightened tensions between the US, Russia and China, and a looming debt ceiling fight in congress. While this data is mostly discouraging for stocks, it does lay the groundwork for interest rates to begin declining later this year or early next year, which is good for your pension lump-sum value due to its inverse relationship with interest rates.

At Capstone Wealth Advisors, we specialize in understanding the inner workings of your BP Retirement Plans and how to help you make decisions that best suit your individual situation. If you’re considering retiring this year or next, we cannot stress enough the importance of getting professional advice during this highly volatile time. Choosing the wrong month to collect your retiree benefits could cost you tens of thousands of dollars.

We’re offering a complimentary consultation with our experienced financial advisors, to provide guidance on how your pension is affected by interest rates and help you navigate the current financial landscape. This service is free of charge for all BP Employees and Retirees.

To schedule your consultation, please email us at info@capstonewealthadvisors.com or call us directly at (877)739-6007.

Thank you for entrusting us with your retirement planning. We look forward to hearing from you soon.

Regards,

Capstone Wealth Advisors

Bellingham, WA

877-739-6007

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk, including loss of principal. International & Emerging Markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in Emerging Markets.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Confidentiality Notice: This email transmission and its attachments, if any, are confidential and intended only for the use of particular persons and entities. They may also be work product and/or protected by the attorney-client privilege or other privileges. Delivery to someone other than the intended recipient(s) shall not be deemed to waive any privilege.

Capstone Wealth Advisors and its representatives are separate and apart from any other named entity.