ATTN BP Employees,

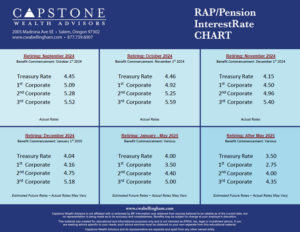

The top row contains the official interest rates used to calculate your pension for the months listed. The bottom row contains Capstone Wealth Advisors’ estimate of where we are forecasting rates for the various future dates listed.

What You Need to Know:

- Interest Rates used to calculate your BP RAP pension came in close to our forecasted estimates from last month. This impacts BP Retirees selecting December 1st as your Benefit Commencement Date. For September’s interest rate forecast, we anticipate rates will move even more considerably lower. Heritage Employees 60-65 years old should see the greatest benefit from this, but all participants should be positively impacted to some degree.

- What Does this Mean for You? BP Employees looking to retire this year should pay close attention to how your pension lump-sum values are impacted by falling interest rates. As we anticipated, the Federal Reserve began lowering its benchmark interest rate on September 18th, 2024. BP Retirees may want to consider whether postponing filing to collect your pension is a smart option for you.

It’s important to note that waiting to file for your pension does not impact when you can retire from BP, you can file to collect your pension at any time post separation from BP (even years into the future). We strongly encourage you to speak with one of our experienced financial advisors to help you understand what impact rate decreases could have on your BP RAP and your overall retirement goals. We can help you understand the best option for your long-term retirement planning needs.

- Why Have Rate Expectations Shifted? The economic landscape has evolved since the Federal Reserve’s last meeting. While labor market data shows signs of moderation, the economy remains resilient, with GDP and consumer spending staying robust. Inflation continues to cool, though the Fed is wary of declaring victory just yet. Fed Chairman, Jerome Powell’s comments indicate that while the Fed is in a “calibration” phase, which involves balancing inflation and economic growth, rate cuts are not a given in the short term. Instead, a more measured approach to lowering rates will depend on how the economic picture unfolds.

- What’s Next? Looking ahead, the Fed’s path is less certain than before. While rate cuts are still anticipated in the longer term, the timing and size of these cuts will depend on upcoming data. Current expectations suggest a gradual reduction, potentially bringing the benchmark rate down to 2.75% by mid-2025. However, this scenario is highly dependent on future economic conditions. BP employees and retirees should remain informed about these developments, as shifts in interest rates could significantly affect retirement planning and pension values.

Need Some Guidance?

Don’t worry if this all feels confusing, we’re here to help! Our team of financial advisors is well-versed in all things related to BP retirement plans. Whether it is the BP RAP, ESP, SVP, RRSP, or any other BP-related plans, we have you covered.

Want to learn more? Simply email us at info@capstonewealthadvisors.com or give us a call at (877)739-6007.

Best wishes,

Capstone Wealth Advisors

Bellingham, WA

877-739-6007

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk, including loss of principal. International & Emerging Markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in Emerging Markets.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Confidentiality Notice: This email transmission and its attachments, if any, are confidential and intended only for the use of particular persons and entities. They may also be work product and/or protected by the attorney-client privilege or other privileges. Delivery to someone other than the intended recipient(s) shall not be deemed to waive any privilege.

Capstone Wealth Advisors and its representatives are separate and apart from any other named entity.