Attention BP Employees,

The economic picture in the United States and globally remain uncertain as markets adjust to the ever-changing landscape. The ultimate outcome of the issues plaguing America remains to be seen; however, we do see this situation ultimately getting behind us, in time.

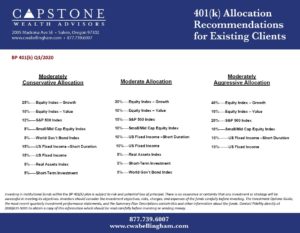

Our BP ESP model portfolios have been adjusted to reflect our belief that an overweighting in US Large Cap Growth will continue to be the best performer, especially on a risk adjusted basis. We have also added a larger component into bonds to help reduce the overall volatility in your portfolio should we experience another pullback.

For current clients, we have already made the changes in your Capstone accounts to reflect our insight looking forward. Please keep in mind that we do not make changes to your BP ESP, that is something you will need to do. If you would like assistance with updating your BP ESP, please do not hesitate to contact us and we can walk you through the steps. Updating your asset allocation is easy to do and can be done in just a few minutes so there is no reason to delay.

To better understand which of our models is right for you, please follow the link below to a short survey that will help you determine what your risk tolerance is.

Click Here for Your Free Risk Tolerance Assessment

For those of you who are not currently a client, we invite you to join our growing clientele. Speaking with one of our advisors is complimentary. We can discuss your specific situation including matters such as your pension or transition into retirement or another career. Email us at tyler@capstonewealthadvisors.com or contact our office directly at (877)739-6007 to schedule.

Click here to view our Q3/2020 BP ESP Model Allocations

Regards,

Tyler E Ryan

Capstone Wealth Advisors

877-739-6007

cwabellingham.com

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk, including loss of principal. International & Emerging Markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in Emerging Markets.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Confidentiality Notice: This email transmission and its attachments, if any, are confidential and intended only for the use of particular persons and entities. They may also be work product and/or protected by the attorney-client privilege or other privileges. Delivery to someone other than the intended recipient(s) shall not be deemed to waive any privilege.

Capstone Wealth Advisors and its representatives are separate and apart from any other named entity.