ATTN BP Employees,

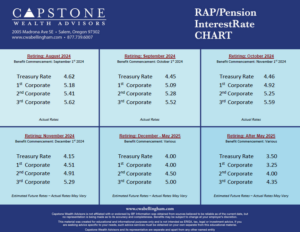

Updated interest rates that impact your BP Pension (BP RAP) have been released. For a clear understanding of these changing rates, please find our attached interest rate chart detailing the current interest rates influencing your BP RAP and our predictions for where they may head in the future.

Updated interest rates that impact your BP Pension (BP RAP) have been released. For a clear understanding of these changing rates, please find our attached interest rate chart detailing the current interest rates influencing your BP RAP and our predictions for where they may head in the future.

The top row contains the official interest rates used to calculate your pension for the months listed. The bottom row contains Capstone Wealth Advisors’ estimate of where we are forecasting rates for the various future dates listed.

What You Need to Know:

- Interest Rates used to calculate your BP RAP pension came in very close to our forecasted estimates from last month. This impacts BP Retirees selecting November 1st as your Benefit Commencement Date. For August’s interest rate forecast, we anticipate rates will move noticeably lower, with the 1st Corporate Segment rate plunging below 4.8% and reaching a level not seen in nearly two years. Heritage Employees 60-65 years old should see the greatest benefit from this, but all participants should be positively impacted to some degree.

- What Does this Mean for You? BP Employees looking to retire this year should pay close attention to how your pension lump-sum values are impacted by falling interest rates. As discussed above, The Federal Reserve is widely expected to begin lowering its benchmark interest rate on September 18th, 2024. BP Retirees may want to consider whether postponing filing to collect your pension is a smart option for you.

It’s important to note that waiting to file for your pension does not impact when you can retire from BP, you can file to collect your pension at any time post separation from BP (even years into the future). We strongly encourage you to speak with one of our experienced financial advisors to help you understand what impact rate decreases could have on your BP RAP and your overall retirement goals. We can help you understand the best option for your long-term retirement planning needs.

- Why Are Interest Rates Expected to Fall? Recent economic data has hinted that the US Labor Market may be starting to cool down somewhat, while at the same time GDP and Retail Spending remains resilient. This coupled with inflation levels continuing to moderate, gives the Fed the wiggle room it needed to begin lowering its benchmark interest rate at its next meeting on September 18th. Expectations of this move have caused bond markets to react accordingly, resulting in lower interest rates across the board for each of your BP RAP Corporate Segment Bond Rates.

- What’s Next? Looking ahead (and assuming economic data continues to come in as expected), the Federal Reserve will almost certainly lower rates next month. The big question is by how much, will it be -0.25% or possibly -0.50%? Current probabilities of rate cuts show that over the next year, the Fed is expected to continually lower its benchmark interest rate a full -2%, to 3.25% by July 2025. Whether or not economic conditions ultimately warrant a decrease of this magnitude remains dependent on how the economic picture continues to unfold. I strongly encourage all BP employees to stay informed about these developments as they could impact retirement planning and pension values significantly.

Need Some Guidance?

Don’t worry if this all feels confusing, we’re here to help! Our team of financial advisors is well-versed in all things related to BP retirement plans. Whether it is the BP RAP, ESP, SVP, RRSP, or any other BP-related plans, we have you covered.

Want to learn more? Simply email us at info@capstonewealthadvisors.com or give us a call at (877)739-6007.

Best wishes,

Capstone Wealth Advisors

Bellingham, WA

877-739-6007

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk, including loss of principal. International & Emerging Markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in Emerging Markets.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Confidentiality Notice: This email transmission and its attachments, if any, are confidential and intended only for the use of particular persons and entities. They may also be work product and/or protected by the attorney-client privilege or other privileges. Delivery to someone other than the intended recipient(s) shall not be deemed to waive any privilege.

Capstone Wealth Advisors and its representatives are separate and apart from any other named entity.